uk tax incentives for electric vehicles

Finally if used as company cars electric vehicles and vehicles emitting less than 60g CO2km do not pay tax. The EV grant limit is now capped at 1500 and its only available on cars costing less than 32000.

Plug In Electric Vehicle Policy Center For American Progress

Car fuel benefit charge.

. The electric car tax on BIK rate will increase to 1 in 2021 2022 and 2 in 2022 2023. New Zealand is the latest country to offer cash rebates for switching to EVs. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Electric vehicle incentives in Germany. The majority of European countries offer an exemption from road tax for electric vehicles. In 2020-21 the electric van was taxed at 80 of the benefit for a normal van which was 3490.

For a plug-in hybrid electric vehicle PHEV the incentive is 2500. While the pandemic oversaw a global car sales drop of 16 electric car registrations grew by. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same.

The number of electric cars registered in the UK as of the end of March 2021 was more than 495000 plug-in vehicles with approx. As more people than ever opt for electric vehicles. The average petrol or diesel vehicle has a BiK rate of 20 to 37 percent.

This is a great saving for businesses. Between 1 April to 31 March. President Bidens EV tax credit builds on top of the existing federal EV incentive.

Although the UK government recently got bad press for reducing the EV purchasing grant incentive from a maximum of 3000 to 2500 the country enjoys an excellent overall score of 75 for their promotion of EV adoption the third best in Europe. 235000 BEVs and 260000 PHEVs registered. The rates for all 100 electric vehicles are now 0 and this will apply until at least 2025.

Every pure electric vehicle costing less than 40000 is. 655 The tax charge for zero-emission vans increases in 2020-2021 to 80 from 60 of the main rate. EV Incentives in the UK.

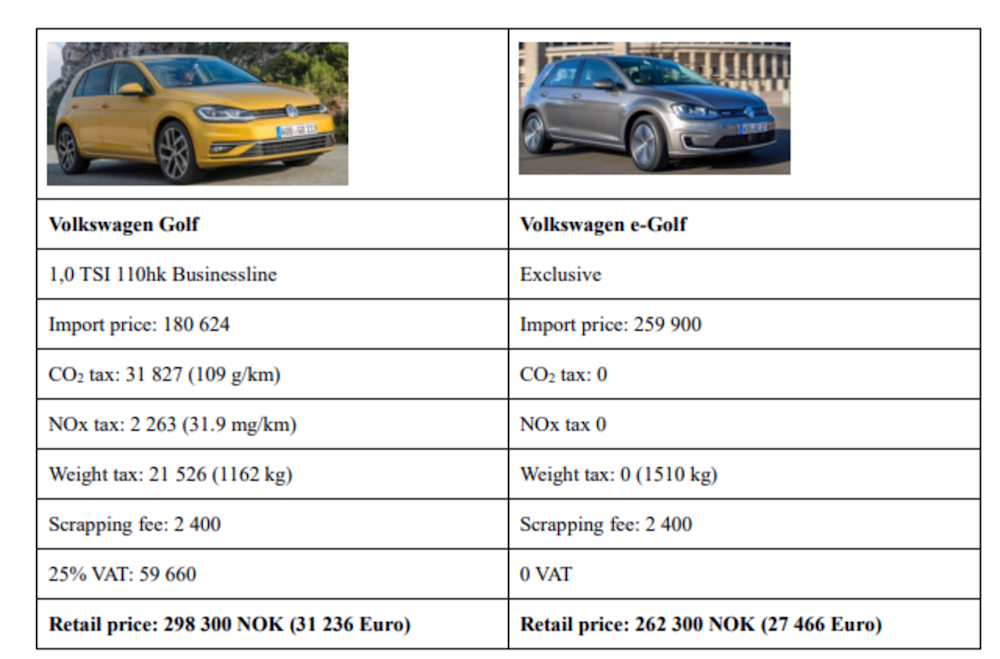

Tax bonuses in Norway have closed the price gap between EVs and conventional cars. Back then it was worth up to 35 of the cost of a new vehicle with a 5000 cap. The grant will pay for 20 of the purchase price up to a maximum of 25000 for these vehicles.

Businesses that buy EVs can write down 100 of the purchase price against their corporation tax liability if the vehicle emits no more than 50gkm CO2 paying just 1 CCT in 2021 and 2 in 2022. So the charge was 2792. The taxable benefit for having the private use of a zero-emission van was reduced to zero in April 2021.

Benefit-in-kind tax for electric cars. For 2019-20 low emission cars up to 50gkm are taxed at 16 of list price or 20 for diesels. This funding is available for models costing up to 32000.

This rate also applies to hybrid vehicles with a CO2 emissions figure of below 50gkm and a pure electric range of 130 miles. Tax on Benefits in Kind BiK Effective from 6th April 2020 fully electric cars will be zero BiK for 202021 1 for 202122 and 2 for 202223. 100 First Year Allowance FYA First Year Allowance is claimable for up to 100 of the cost of qualifying low emission and electric cars.

Other incentives for switching to electric vehicles Vehicle Excise Duty. There are also tax-exemption benefits on Registration Tax and VED Road Tax for zero emission vehicles and reduced tax for plug-in hybrid. Tax for electric vehicles.

One of the most important incentives for private vehicle owners to go electric is to take advantage of the Plug-In Car Grant which covers up to 2500 of the cars purchase price depending on the model. There is no taxable benefit at all if the van is only used for business journeys and ordinary. Plug-in hybrid electric vehicles PHEVs have reduced rates but some VED is payable depending on emissions.

Current Plug-in Car Grant levels provide up to 1500 off the cost of a new Category 1 model essentially pure-electric models or range-extended EVs meeting the criteria. The amount of the electric car grant - often referred to as the Plug-in Car Grant PICG - has fallen steadily since its introduction in 2011. 10 of total car sales are made up of alternatively fuelled vehicles.

As an example a Tesla S compared with a Mercedes S 450 L AMG Line. 24100 Van benefit-in-kind tax charge. Government grants as well as reductions in tax costs aim to make electric motoring more affordable.

However from April 2021 the Government will apply a nil rate for tax to zero. 3430 Van fuel benefit charge. The UK government has cut grants for electric vehicles for the second time in a year provoking the anger of the car industry and prompting a call for car tax to be redesigned.

A further incentive to investing in an e-vehicle is the road tax payable Vehicle Excise Duty VED. Close to 13 billion in plug-in vehicle grant funding to bring ultra-low emission vehicles. Theres currently zero tax on Benefit in Kind BIK during 2020 2021 for hybrid vehicles with emissions from 1 - 50gkm and a pure electric range of over 130 miles.

However there have been significant reductions in this charge from April 2020 with electric-only cars falling to 0 in 2020-21 as well as reductions for electric hybrids depending on their electric-only range. In Germany electric vehicles are exempt from the annual road tax for ten years after registration. Traditionally employers have been able to offer company cars as an added benefit when attracting new employees.

Electric car incentives are helping to increase sales of electric vehicles EVs worldwide. Electric av UK mix 0cc 0 litre EV400 S 90kWh 400PS Auto. Benefit in Kind Company Car Tax Rules Review of WLTP and Vehicle Taxes Budget 2020.

Plus there are financial incentives available now to help drivers reduce the price of an EV. The UK governments Plug-In Car Grant PICG currently offers 2500 off the cost of an electric car but only for vehicles costing less than 35000. Petrol 2998cc 3 litre 540i xDrive M Sport.

Pure electric vehicles costing less than 40000 are exempt from the Vehicle Excise Duty annual road tax. Tax on benefits in kind for electric cars. Can travel at least 96km 60 miles without any emissions at all.

Understanding Federal Tax Credits For Electric Cars Capital One

How To Drive Electric Vehicle Uptake In Your City

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Electric Vehicles Should Be A Win For American Workers Center For American Progress

Germany S Vehicle Tax System Small Steps Towards Future Proof Incentives For Low Emission Vehicles International Council On Clean Transportation

How Do Electric Vehicles Compare To Gas Cars Wallbox

Road Tax Company Tax Benefits On Electric Cars Edf

Electric Cars The Surge Begins Forbes Wheels

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

The Tax Benefits Of Electric Vehicles Saffery Champness

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

Electric Vehicles As An Example Of A Market Failure

A Complete Guide To Ev Ev Charging Incentives In The Uk

Future Transportation Free Full Text Consumer Adoption Of Plug In Electric Vehicles In Selected Countries Html

The Tax Benefits Of Electric Vehicles Saffery Champness

Electric Vehicles Close To Tipping Point Of Mass Adoption Electric Hybrid And Low Emission Cars The Guardian

Is Charging An Electric Car Cheaper Than Filling Up With Petrol Evbox

Ev Tax Credit Plan Draws Ire From Non Union Toyota Tesla Bloomberg